Private debt, also commonly called private credit, has emerged as a growing component of the global financial landscape. As traditional banking systems and public debt markets face challenges, private debt has stepped in to fill funding gaps, offering unique opportunities for both borrowers and investors.

With the private debt market nearing $2 trillion in assets under management (AUM) and projected to grow further, understanding this asset class is essential for modern investors. This article will break down what private debt is, its types, its role in portfolios, and why it’s gaining traction today.

What Is Private Debt?

Private debt refers to loans or other forms of debt financing provided by private entities, such as individuals, companies, or funds, rather than governments or public institutions. Unlike public debt, which includes government bonds and other securities traded in regulated markets, private debt is typically not traded on public markets and includes various forms such as direct lending, bridge lending, mezzanine financing, and distressed debt.

Private debt plays an important role in providing capital to businesses, especially those in the middle market or in need of specialized funding solutions. It’s a growing asset class that offers alternative investment opportunities for investors who are looking for diversification and the potential for higher returns compared to traditional debt.

Types of private debt

Private debt comes in many forms, each with unique characteristics and terms. Here are some key categories:

- Direct lending: These are loans provided directly to small- and medium-sized enterprises (SMEs), often secured by assets. This type of lending bypasses traditional banks and offers more flexible terms to borrowers.

- Mezzanine financing: A hybrid of debt and equity, offering higher returns but with more risk, as it does not sit in a senior position on the capital stack. It often includes equity kickers like warrants, which allow lenders to convert debt into equity if the borrower defaults.

- Distressed debt: This involves purchasing debt from companies in financial trouble at a discount, with the potential for high returns if the company recovers. This type of debt has historically been used by investors looking to gain control of a company through its debt.

- Private debt in real estate: Private debt in real estate refers to loans made to property owners outside traditional bank channels, providing exposure to real estate without owning physical properties. These loans are typically short-term and used to finance specific projects or parts of real estate development. For those familiar with real estate equity investing, private debt in real estate represents a natural progression and an accessible entry point for investors. This approach allows investors to leverage their existing knowledge of real estate. They can benefit from the substantial returns and lower risk associated with private debt.

- Venture debt: Debt provided to early-stage startups, usually alongside venture capital investments. This type of debt helps startups extend their runway without diluting equity.

- Peer-to-peer lending and private consumer debt: Often digital platforms that facilitate loans between individuals or small businesses. These platforms offer an alternative to traditional bank loans and can provide higher returns to investors.

- Collateralized loan obligations (CLOs): Structured finance products that pool various loans and issue tranches with different risk levels. CLOs offer investors exposure to a diversified portfolio of loans.

- To learn more, read our article, “Why Savvy Investors Should Consider Private Debt in Real Estate.”

What Is Public Debt?

While private debt is a growing component of the global financial landscape, it exists alongside public debt. Public debt refers to debt securities that are issued in open markets and accessible to a wide range of investors. These include government bonds, corporate bonds, and high-yield (junk) bonds.

Understanding the distinctions and interconnections between private and public debt is essential for investors seeking to diversify their portfolios.

Key differences between private and public debt

| Feature | Private Debt | Public Debt |

| Issuer | Private entities (e.g., individuals, companies, funds) | Governments, corporations, municipalities |

| Liquidity | Illiquid | Highly liquid |

| Customization | Tailored to borrower needs | Standardized |

| Access | Limited to institutional/accredited investors | Available to all investors |

| Risk-return profile | Higher risk, higher yield | Lower risk, lower yield |

Examples of Public Debt Instruments

1. Sovereign debt

- Definition: Issued by national governments to fund public expenditures

- Example: U.S. Treasury bonds (T-Bonds), U.K. Gilts, Japanese Government Bonds (JGBs)

- Performance: Over the past 20 years, U.S. Treasuries have delivered average annual returns of 4%-5%, with yields declining significantly during periods of monetary easing (e.g., post-2008 crisis).

2. Corporate bonds

- Definition: Issued by companies to raise capital for operations or expansion

- Example: Apple’s investment-grade bonds, or the Dow Jones Equal Weight US Corporate Bond

- Performance: The Dow Jones Equal Weight US Corporate Bond has an annualized return of 2.52% over the past decade.

3. Municipal bonds

- Definition: Issued by state or local governments to fund infrastructure projects

- Example: California’s municipal bonds for transportation projects, or the S&P Municipal Bond Index

- Performance: The S&P Municipal Bond Index has an annualized return of 2.31% over the past decade.

4. High-yield (junk) bonds

- Definition: Corporate bonds with lower credit ratings, offering higher yields

- Example: SPDR Bloomberg High Yield Bond ETF (JNK Index). Some of the companies with BBB- ratings or lower included in the ETF are Charter Communications, Tenet Healthcare, and Community Health Systems.

- Performance: The JNK Index has an annualized return of 4.94% over the past 15 years, but has been prone to sharp declines during economic downturns.

Comparing Private Debt With Public Debt

Private debt and public debt serve different purposes and come with distinct risk and return profiles. Here’s a comparison using some common indices and investment instruments:

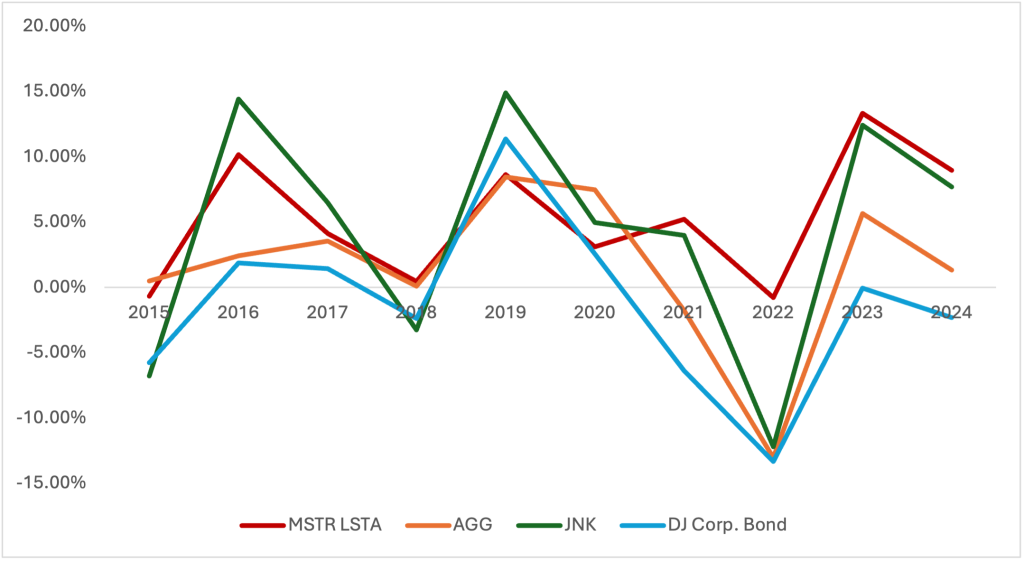

- MSTR Levered Loans Index (LSTA): This index tracks private debt to corporations, providing valuable insights into the performance of loans made directly to private companies. While it may not fully represent the entire private debt market, it serves as a proxy that reflects private debt performance.

- Bloomberg Aggregate Bond Index: Represents investment-grade bonds, providing a benchmark for bond performance. This index includes a wide range of high-quality bonds and is often used as a benchmark for fixed-income investments.

- Corporate bonds: Debt issued by corporations, typically offering higher yields than government bonds, but with more risk. Corporate bonds are a common way for companies to raise capital. An example is the Dow Jones Equal Weight US Corporate Bond, designed to track the total returns of 100 large and liquid investment-grade bonds issued by companies in the U.S.

- JNK ETF: Tracks high-yield bonds, also known as junk bonds, which offer higher returns but come with higher risk. The volatility of junk bonds can be as high as equity investments. This instrument includes bonds from companies with lower credit ratings (BBB- rating or lower).

Here’s the past 10-year return for these indices:

The Role of Private Debt in Modern Portfolios

Private debt plays a crucial role in modern investment portfolios by offering several benefits:

- Portfolio diversification: Private debt can reduce overall portfolio risk through diversification. By adding private debt to a portfolio, investors can spread their risk across different asset classes and reduce their exposure to market volatility.

- Stable returns: Provides stable returns across market cycles, often with lower volatility compared to public debt. Private debt investments are typically less affected by market fluctuations and can offer more predictable income streams. As shown by the chart, the MSTR LSTA has exhibited less volatility during 2015, 2018, 2021, and 2022 compared to the other fixed-income instruments.

- Inflation protection: Many private loans have floating interest rates tied to benchmarks like the Secured Overnight Financing Rate (SOFR), which adjust upward during inflationary periods, protecting investors’ purchasing power.

- Historical performance: Private debt has demonstrated resilience and strong performance during various stressed economic conditions.

This chart includes periods of high stress over the past 25 years, illustrating the performance of different fixed-income investments. Notably, an outlier occurred during the 2008 Global Financial Crisis (GFC), when the MSTR LSTA Index significantly underperformed due to its liquidity issues and perceived risk profile.

Why Investors Are Paying More Attention to Private Debt Today

Several factors are driving the increased interest in private debt:

- Search for higher yield: Private debt has many factors that allow it to generate higher yields than traditional public fixed-income investments. Unique supply and demand characteristics, increased complexity, and lower market accessibility are just some of these factors.

- Lower volatility and stable returns: Private debt has garnered increased interest due to its ability to offer attractive returns in both high- and low-interest rate environments. In a high-interest rate cycle, floating interest rates on private debt instruments help protect investors from interest rate risk and allow lenders to capture higher yields. Conversely, in a low-interest rate cycle, while public yields may compress, private debt often sees less compression.

Lower interest rates can also create benefits by reducing default rates and stimulating economic activity, leading to increased deal flow. This adaptability and resilience make private debt an appealing option for investors seeking stability in various economic conditions. - Education and availability: An increase in education and a more diverse universe of investment options in private debt have led to increased allocations from both retail and institutional investors as they seek to control risk and enhance returns.

- Growth of private equity synergies: The rise of private equity has fueled demand for complementary financing solutions like mezzanine loans and direct lending for leveraged buyouts (LBOs).

Watch our webinar on the Rise of Private Credit to learn more.

Macroeconomic factors that create opportunity for private debt

- Economic slowdowns: Periods of low economic growth or recessions can lead to increased demand for private debt as businesses seek alternative financing sources when traditional banks tighten lending standards.

- Interest rate volatility: Fluctuating interest rates can impact the cost of borrowing and lending. Private debt instruments often feature floating interest rates, which adjust to market changes, helping protect investors from interest rate risk.

- Inflation: High inflation can erode the real value of fixed-income investments. Private debt, with its potential for higher yields and floating rates, can offer better protection against inflation compared to traditional fixed income.

- Regulatory changes: Post-2008 financial regulations have restricted banks’ lending capabilities, creating a gap that private debt has filled. Ongoing regulatory scrutiny and changes can impact the availability and terms of traditional financing, making private debt a more attractive option.

- Market disruptions: Events like the COVID-19 pandemic disrupted traditional financial markets, leading to increased demand for private debt as businesses seek flexible, accessible funding.

- Geopolitical risks: Political instability and geopolitical tensions can create uncertainty in global markets. Private debt’s lower correlation with traditional markets can provide a diversification benefit, helping mitigate risks associated with geopolitical events.

Final Thoughts

Private debt has evolved from a niche asset class to an essential component of diversified investment strategies, offering unique opportunities for portfolio diversification, consistent income streams, and potentially higher returns than traditional fixed-income investments. With increased educational resources, investors can better understand the various types of private debt and make more informed decisions.

As the market is projected to grow to an estimated $2.8 trillion by 2028, now is an opportune time for investors to explore this dynamic asset class. Whether through direct lending, venture debt, or CLOs, private debt aligns with modern financial goals, providing stable income, portfolio diversification, and inflation protection. Investors should consider their risk tolerance and liquidity needs before diving into this complex yet rewarding space, and consult financial advisors or experts when structuring their portfolios around this promising asset class.

Not sure if private debt is right for you? Take our short Private Debt Suitability Assessment: https://kirklandcapitalgroup.com/private-debt-suitability-assessment

Let’s connect! Follow me on PassivePockets here.

About the Author

With 29 years in the investment sector, Chris Carsley has developed an expertise in various aspects, including portfolio and risk management, valuation, compliance with regulations, corporate and venture financing, operational efficiency in business, research, analysis, trading, and hedging strategies. He holds the title of CIO and managing partner at Kirkland Capital Group, overseeing portfolio management, risk evaluation, and operational functions for their Kirkland Income Fund, a microbalance fund focused on commercial real estate bridge loans. His extensive experience has spanned serving individual investors, family offices, trusts, and corporate benefit schemes, as well as roles across hedge funds, venture capital, and managed futures trading.

Carsley co-founded the Seattle Alternative Investment Association in 2004 and serves on the executive board of the CAIA Pacific Northwest chapter since its inception in 2017. He received his CFA designation in 1998 and the Chartered Alternative Investment Analyst title in 2011.

Chris maintains active interests outside of finance, including scuba diving, skiing, and martial arts. He is also a University of Portland graduate with a Bachelor of Business Administration